Mortgage Pre-approval Checklist

A completed and signed application form

Mortgage Pre-Approval Checklist

Identification documents such as Drivers Licence, Passport or Medicare Card

Proof of income such as latest 2 payslips or last 2 years tax returns if self-employed. (One year tax return could be considered on case by case basis)

Evidence of applicant’s contribution towards the house purchase.

Details of monthly living expenses forecast.

Disclosure of any adverse credit history profile.

Details of current liabilities or debts such as home loans, credit cards, personal loans, vehicle loans, HECS or Help Debt and any other

A pre-approval evaluates whether you qualify for a loan, and estimates the maximum amount that the lender would be willing to lend.

If Lenders Mortgage Insurance is required, last 3 months’ bank statements reflecting 5% genuine savings balance.

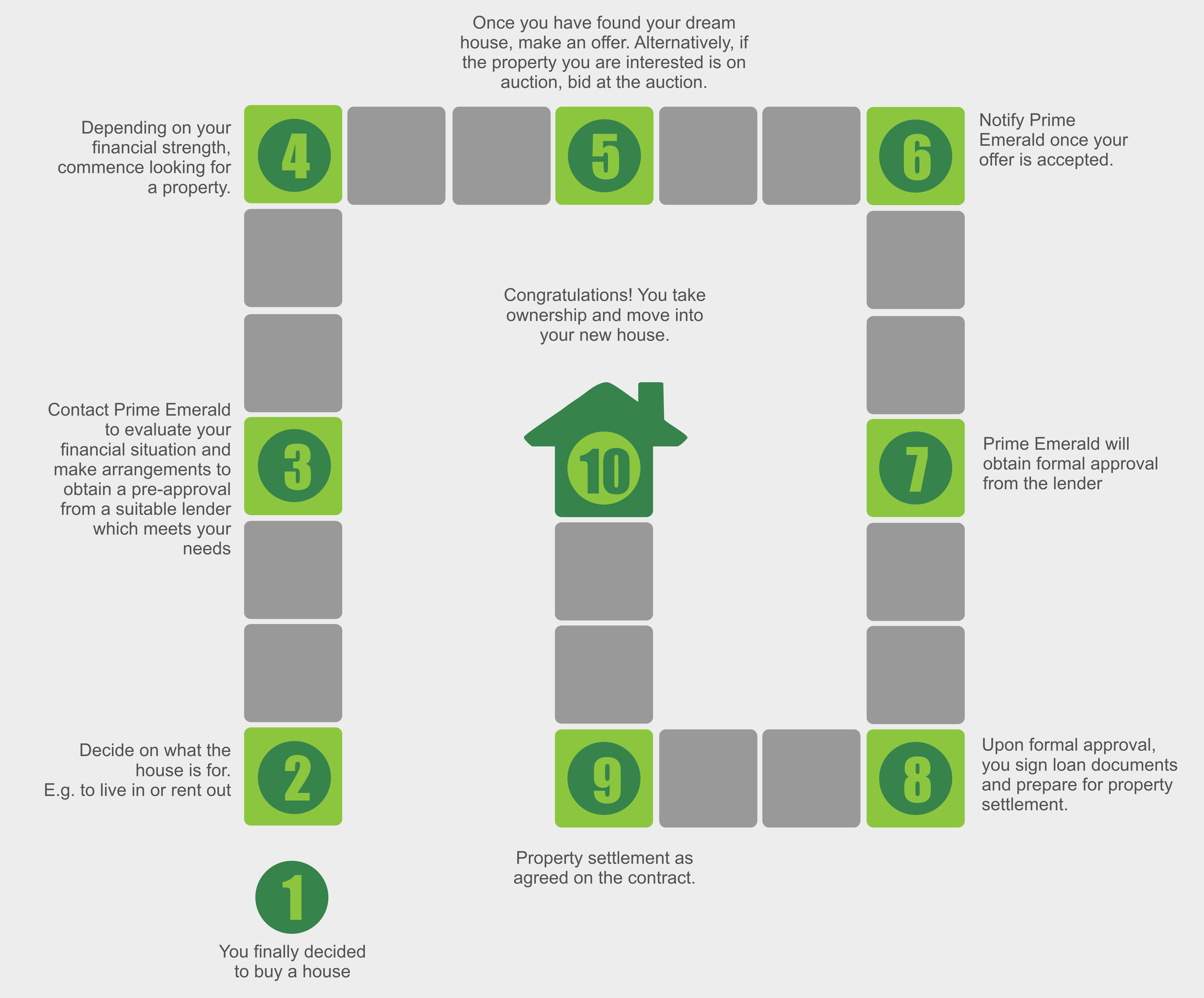

Home Buyers Journey

10 steps to a better home loan

Why choose a mortgage broker?

More choice

When you are sitting in front of a mortgage broker you are sitting in front of a number of banks and hundreds of products versus a banker who has access to limited banking products. When banks have limited products to recommend, you are more likely to get a “No”.

Specialisation

A Broker can be seen as a loan expert dealing with wider customer needs and products. By engaging a broker with specialist knowledge of lender policies and approval guidelines, you significantly reduce the risk of being refused a home loan.

Experience

Brokers often own their own business and are committed for long term to their customers. Lending is all they do and can give you professional advice to match your needs with suitable lending solution.

When you are sitting in front of a mortgage broker you are sitting in front of a number of banks and hundreds of products versus a banker who has access to limited banking products. When banks have limited products to recommend, you are more likely to get a “No”.

Specialisation

A Broker can be seen as a loan expert dealing with wider customer needs and products. By engaging a broker with specialist knowledge of lender policies and approval guidelines, you significantly reduce the risk of being refused a home loan.

Experience

Brokers often own their own business and are committed for long term to their customers. Lending is all they do and can give you professional advice to match your needs with suitable lending solution.

Saves money and time

Mortgage Brokers can compare hundreds of home loans from dozens of lenders and identify the best deal, saving money in terms of interest rates and fees. Also, a broker does all documentation; manage the whole process on your behalf whilst you spend time with your family and friends.

Follow-ups

Following up your loan application with banks can be time consuming and frustrating. With a mortgage broker, due to personalised service, will keep you informed in advance and provide advice at every step.

Long - term peace of mind

Bank staff change so often and you may have to deal with different employees. A mortgage broker will look after you for the life of your loan and make sure you’re always in the best financial position.

Broker is the perfect financial partner

Because the broker has a good understanding of your financial position, they are well placed to help you if your application hits a hurdle rather than leaving you to deal with on your own.

Mortgage Brokers can compare hundreds of home loans from dozens of lenders and identify the best deal, saving money in terms of interest rates and fees. Also, a broker does all documentation; manage the whole process on your behalf whilst you spend time with your family and friends.

Follow-ups

Following up your loan application with banks can be time consuming and frustrating. With a mortgage broker, due to personalised service, will keep you informed in advance and provide advice at every step.

Long - term peace of mind

Bank staff change so often and you may have to deal with different employees. A mortgage broker will look after you for the life of your loan and make sure you’re always in the best financial position.

Broker is the perfect financial partner

Because the broker has a good understanding of your financial position, they are well placed to help you if your application hits a hurdle rather than leaving you to deal with on your own.

Free Home Loan Appraisal

Home Loan Review

You can be assured that you will receive a professional service from Rohan Puvi, Finance Specialist - Prime Emerald who has more than 20 years of experience in the industry.

Thanks for the opportunity to assist you in your home loan need. You can access the Home Loan Review Form by clicking the ‘Download Home Loan Review Form’ button.

Once downloaded, fill up the form with your details and email it to Prime Emerald using the email icon for a free loan appraisal.

Once downloaded, fill up the form with your details and email it to Prime Emerald using the email icon for a free loan appraisal.

Credit Guide / Privacy Statement

Credit Guide & Privacy Statement

You can preview our Credit Guide & Privacy Statement here by hitting the VIEW STATEMENT button.

This document provides you with information relating to our activities and those of our credit representatives. It contains information about various fees and charges that may be payable by you to us, as well as about certain commissions we may receive from a licensee when we are acting as a credit representative, or we pay to certain third parties.

It also contains information about what you should do if you have a complaint or dispute in connection with our services as a credit representative.

This document provides you with information relating to our activities and those of our credit representatives. It contains information about various fees and charges that may be payable by you to us, as well as about certain commissions we may receive from a licensee when we are acting as a credit representative, or we pay to certain third parties.

It also contains information about what you should do if you have a complaint or dispute in connection with our services as a credit representative.

Here you will find some helpful tips and resources to help you on your journey to get the loan you seek .